Dear Investors,

The budget presented by our finance minister, Mrs. Nirmala Sitharaman for financial year 2025-26 has managed to make a tightrope walk between reduction of government debt as a % of GDP, allocation towards job creation, infrastructure, and support for MSME & sunrise industries even while increasing allocation to social causes and still staying on growth course.

This update from PurplePond shall be restricted to the major tax impact for individuals and corporates and detailed coverage on budget will shortly be available in the February 2025 newsletter that would be out shortly.

Individual | FY 25-26 Budget Proposal

Relief for Middle-Class & Senior Citizens

➢ Tax deduction (TDS) limit for senior citizens doubled from ₹50,000 to ₹1,00,000

➢ TDS on rent: Annual limit increased from ₹2.4 lakh to ₹6 lakh

➢ Individuals can now claim tax benefits on two self-occupied properties instead of one (No necessity to file IT returns factoring a notional rental income for 2nd self-occupied property)

Encouraging Voluntary Compliance

➢ Time limit to file updated income tax returns extended from 2 years to 4 years

➢ Simplified taxation rules for startups, infrastructure investors, and employment-generating businesses.

Highlights of Budget 2025-26

Development Focus

➢ Inclusive development for Garib (poor), Youth, Annadata (farmers), and Nari (women).

➢ Economic acceleration with investment, exports, MSME growth, and reforms.

➢ Strengthening private sector investment and boosting middle-class spending power.

Agriculture & Rural Development

➢ National Mission on High-Yielding Seeds for better productivity.

➢ Prime Minister Dhan-Dhaanya Krishi Yojana to develop 100 agri-districts benefiting 1.7 crore farmers.

➢ Makhana Board in Bihar to boost production and exports.

➢ Mission for Cotton Productivity to enhance sustainability.

➢ Aatmanirbharta in Pulses with a 6-year mission for Tur, Urad, and Masoor.

➢ Kisan Credit Card (KCC) loans increased to ₹5 lakh for 7.7 crore farmers.

MSME & Business Growth

➢ Micro Enterprise Credit Cards: ₹5 lakh limit for registered MSMEs.

➢ First-time Entrepreneurs Scheme: ₹2 crore loans for 5 lakh new businesses.

➢ Focus Product Scheme for Leather & Footwear: 22 lakh jobs, ₹4 lakh crore turnover.

➢ Support for Toy & Food Processing Sectors.

➢ Revised MSME Classification: Investment & turnover limits increased

Education & Skill Development

➢ 50,000 Atal Tinkering Labs in government schools.

➢ Broadband for all rural schools & health centers.

➢ Bharatiya Bhasha Pustak Scheme for digital Indian language books.

➢ Centre of Excellence in AI for Education with ₹500 crore funding.

➢ Medical Education Expansion: 10,000 new MBBS seats.

➢ PM Research Fellowship: 10,000 fellowships for IIT & IISc research.

Urban Development & Infrastructure

➢ ₹1 lakh crore Urban Challenge Fund for city redevelopment.

➢ Jal Jeevan Mission extended till 2028.

➢ ₹10 lakh crore Asset Monetization Plan.

➢ ₹1.5 lakh crore interest-free loans for state infrastructure projects.

➢ ₹15,000 crore SWAMIH Fund-2 for 1 lakh housing units.

➢ Maritime Development Fund: ₹25,000 crore for long-term financing.

➢ UDAN Scheme: 120 new regional airports, 4 crore passengers

Tourism & Employment Growth

➢ MUDRA Loans for Homestays.

➢ Skill training & e-visa enhancements for tourism.

➢ Top 50 tourist destinations to be developed.

➢ Performance-linked incentives for states to promote tourism.

Financial Sector & Taxation

➢ FDI limit for insurance raised to 100%.

➢ Partial Credit Enhancement Facility for infrastructure bonds.

➢ Grameen Credit Score to assist rural financing.

➢ New Income Tax Bill proposed.

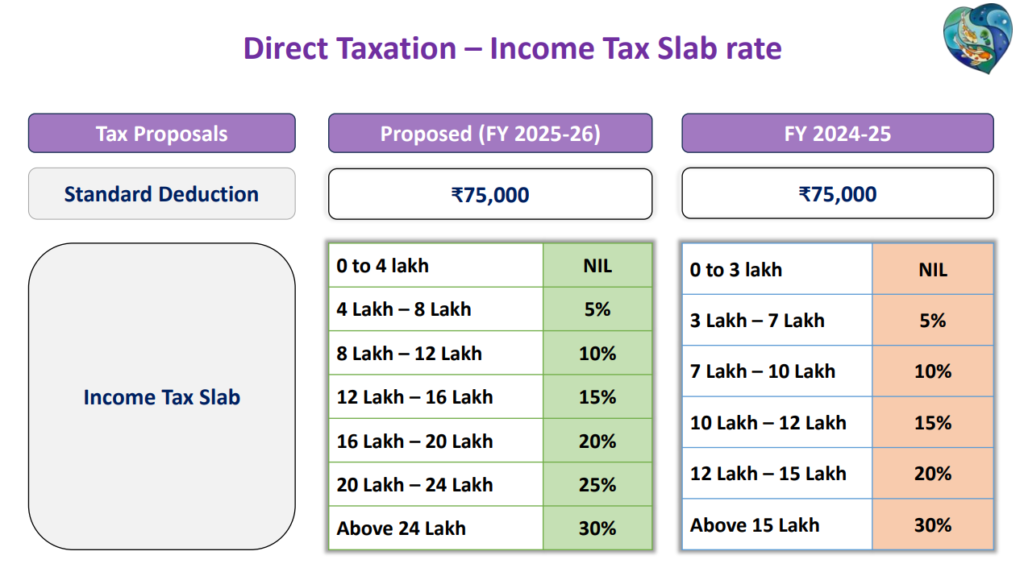

➢ Tax reforms for middle-class

▪ Senior citizen tax deduction limit doubled (₹50,000 → ₹1 lakh)

▪ TDS on rent limit raised (₹2.4 lakh → ₹6 lakh)

▪ More tax certainty for startups & infrastructure investors.

Exports & Trade

➢ Export Promotion Mission to help MSMEs overcome non-tariff barriers.

➢ BharatTradeNet: A digital public infrastructure for global trade.

➢ Warehousing for air cargo to enhance exports.

Customs & Indirect Taxation

➢ Simplified tariff structure: Reduction of multiple rates.

➢ Exemptions for shipbuilding, railway repairs, and EV battery imports.

➢ Lower duties on lifesaving medicines for rare diseases & cancer.

Economic Stability & Fiscal Management

➢ Fiscal deficit targeted at 4.4% of GDP.

➢ Increased tax revenue from income tax & GST.

➢ Higher capital expenditure to drive growth.

We trust that the snippets of the budget are useful to you, Please feel free to reach out to us should you have any further queries. And do read our detailed analysis of the budget in the February 2025 newsletter